Fully Insured Health Plans vs Self Funding

TERMS TO KNOW:

Self-funding goes by a lot of names; self-funded, partially self-funded, stoploss insured and, less frequently, high employer deductible plans. For our purposes we are talking about partially self-funded plans when we say “self-funding” or “self-funded”. By strict definition:

Partially Self-Funded Plans incorporate some insurance to protect the employer against catastrophic claims while the employer takes on the liability of employee claims up to a predetermined limit. These plans are offered and work well for plans with 25 employees and up.

Fully self-Funded Plans are usually reserved for the biggest employers who purchase no insurance policies and choose to take on the full liability of employee claims.

Third Party Administrators (TPAs) are not insurance companies. TPAs assist in managing the employer’s plan, adjudicating claims and coordinating insurance coverages for partially self-funded plans. They typically offer other services as well, such as management of COBRA.

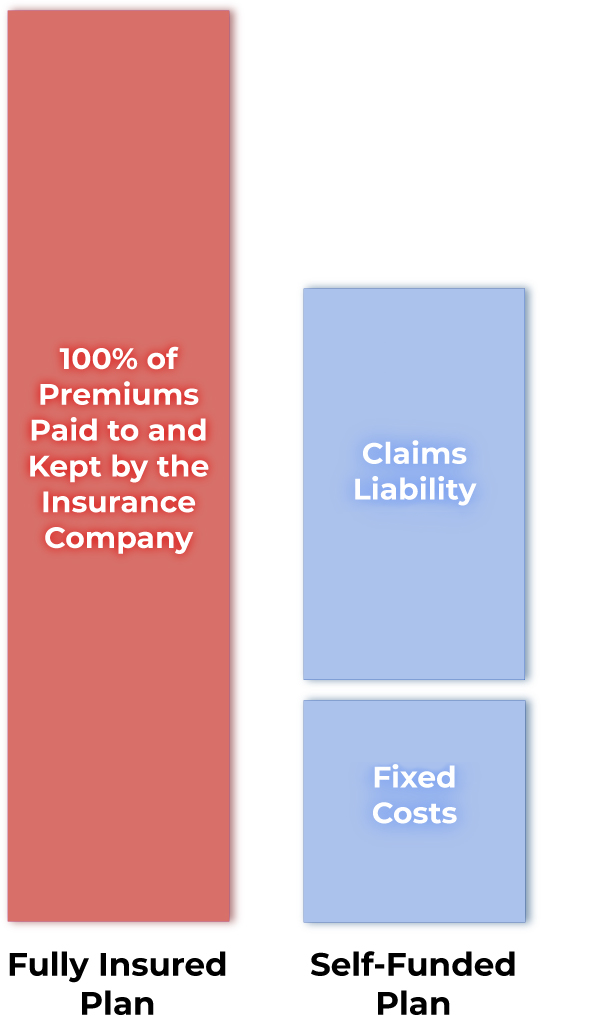

The diagram above illustrates the difference between traditional fully insured plans and self-funded plans.

In a fully insured plan, the employer pays 100% of all premiums to the insurance company. The Insurance company is then responsible for all administration and claims incurred under the contract of the plan. While the insurance company is on the hook for all claims and administrative costs, the carrier keeps all premium dollars not spent. They keep this as profit.

In a partially self-funded plan the employer pays “fixed costs” which include an insurance premium for catastrophic claims protection and administrative fees. On top of the fixed costs the employer will be responsible for “claims liability” which is the actual claims payments to providers. The insurance premiums protect the plan by capping the plans financial liability for medical costs. Any funds that were not spent in fixed costs or claims payments stays in the employer’s bank account.

Two different insurance policies are available and usually purchased by the plan. These two policies are:

- Specific Policy- a cap on the dollar amount of claims per individual, after which the insurance company pays all claims on that individual.

- Aggregate Policy- a cap on the employer’s liability for accumulated paid claims which fall below the Specific Policy deductible.

The total of the “fixed costs” + capped “claims liability” = the employer’s liability up to the deductibles established in the respective policies for the plan year.

(This is divided into 12 monthly payments with fixed costs going to pay stoploss premiums and the TPA while the claims liability portion goes in a “bank” for the employer.) In other words, even if the employer’s workforce has a horrific year in terms of health claims, the employer will pay no more than the maximum “Aggregate” liability for the year. Likewise, if any employee or family member had a high utilization, the employer’s responsibility is capped for that individual at the “Specific”. These are the two important ways employers are protected from paying too much in claims during a given year.

SO…

Imagine a typical plan year for a fully insured carrier. Assume an employer of 100 with an average fully insured cost of $1,000/per employee/per month, equaling $1,200,000 per year. All of that money is paid for premiums which the employer will never see again or have any way of knowing how it was used.

BUT...

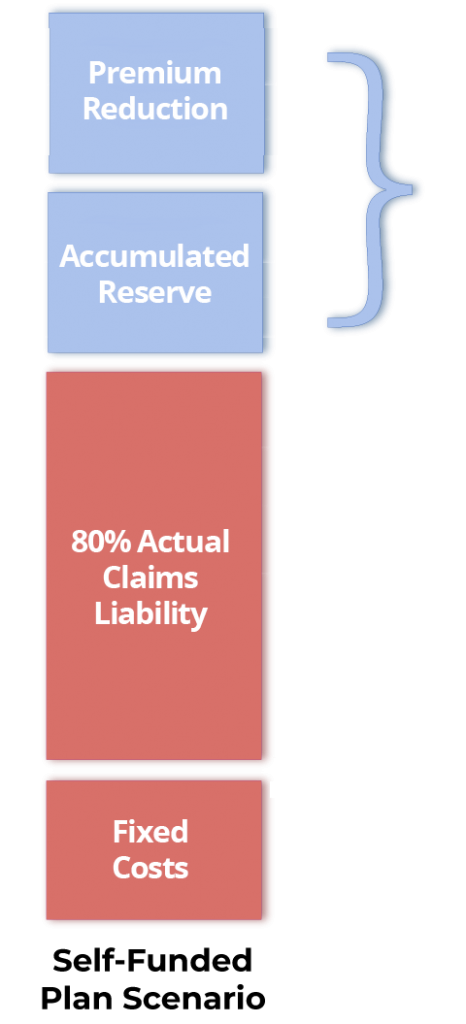

With an MBA self-funded plan, the employer contributes the equivalent of the premiums which are set aside in a dedicated employer benefit plan bank account for the employer’s claims liability. In a typical plan year these contributions are not exhausted. Unlike a fully insured plan, the portion not spent on plan expenses remains in the employer’s bank and under the employer’s control. At the end of the year, employers are able to determine how to handle the accumulated funds.

Total first Year Savings!

Under a self-funded plan, assume the same employer will start the plan year with a claims experience (fixed costs of $300,000 + max claims liability of $600,000) equaling $900,000. (NOTE: The first year’s claims experience is typically 75% of a fully insured plan!)

Also assume that the actual claims for the entire year equaled 80% of the total possible claims liability ($600k x 80%), or $480,000. That leaves $120,000 in the unspent bank that belongs to the employer. This is in addition to the $300,000 already saved over a fully insured plan. In this example the total first year savings is $420,000!

FAQS

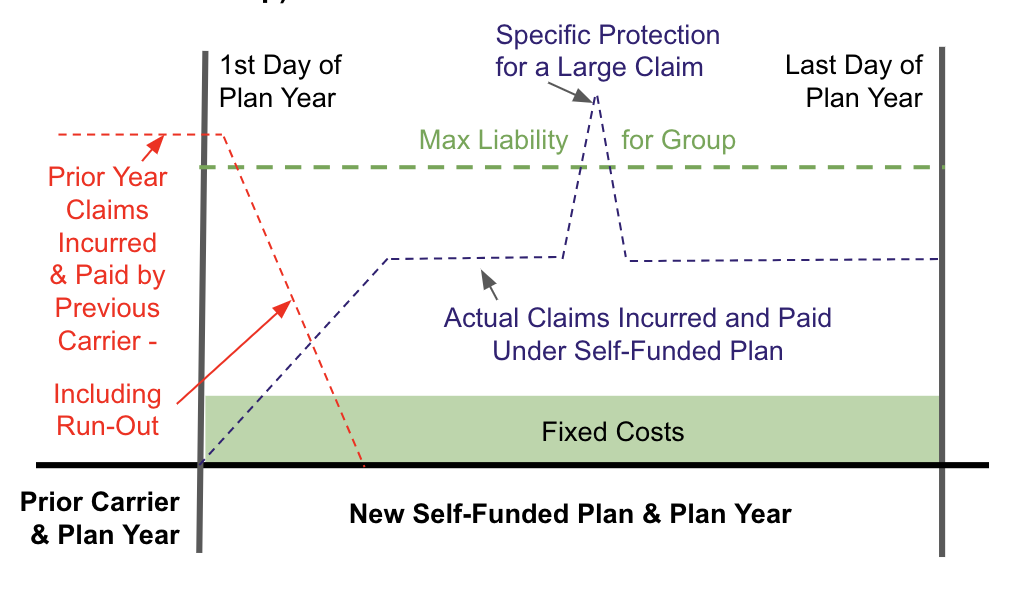

An Important Contract Consideration With Self-Funded Plans

The question of “run-out” claims raises an important distinction within self-funded plans that brokers need to be aware of. As we know, claims incurred during a plan year are still paid by the insurance company into the following year under a fully insured plan. But contracts for self-funded plans are a little more specific when it comes to “incurred” and “paid” exposure.

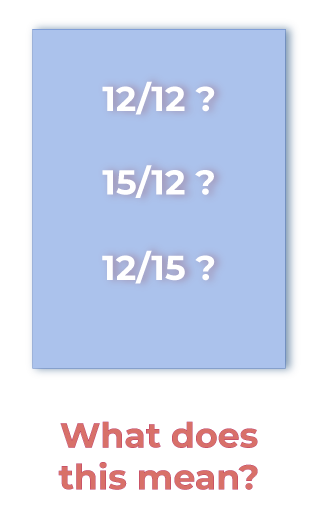

Typically many brokers will present a 12/12 contract in the quote for the first year of a self-funded plan, meaning claims incurred in the 12 months of the plan need to be paid within the 12 months. That leaves a lot of room for run-out claims exposure after the end of the year.

Here is how run-out claims are handled under self-funding:

You can request as 12/15 contract, which means claims incurred in the first 12 months have an extra 3 months into a new year to be paid. So even if the employer leaves the self-funded plan in the second year that employer is protected. A 12/12 contract is less expensive, but a 12/15 might be the plan to present if an employer is self-funding savvy or concerned about run-off.

Likewise, if you are taking over a self-funded plan you need to be concerned about an employer’s current contract. If the employer currently has a 12/12 or 15/12 contract you need to be concerned about run-out claims going into your new plan year. You will likely need a 15/12 contract. This pays claims incurred 3 months prior to the beginning of the new plan and year, leaving no gaps in payment. This may also be a good contract to consider in the second year of self-funding when you yourself offer the renewal.

SALES TIP! If you are in a competitive situation with another self-funded plan, and especially if this is the employer’s first year in self-funding, ask to see the competitor’s quote and bring up the likelihood that this is a 12/12 contract. Raise doubt in the employer’s mind about its suitability due to possible liability for the next year. Then present both a 12/12 and 12/15 contract from MBA; an “apples to apples” and “one deal better” comparison. With MBA your 12/15 contract will still likely be lower than a competitive 12/12 contract and you will have set yourself apart as a trusted advisor who is looking out for the employer’s best interests!

The Advantages of Self-Funding in a Nutshell:

- The potential for employers to save money is very real.

- An employer’s claims liability and expenses are capped.

- Monies not used for claims remain with the employer, not an insurance company.

- Employees see a similar benefit structure unless the employer wants to change benefits.

- Benefit design is very flexible.

- Self-funded plans work well for employers with multiple locations, even across state lines.

- Renewals with MBA are generally flat, and in some cases, decrease.

- Brokers are well taken care of by MBA. Commissions are typically based on a per employee dollar amount.

Related Topics

How to overcome the myths, lies and heresies you may hear about self-funding.

As in every product line, you will run into competition in the larger group market. If a competing broker is unfamiliar with self-funding or is captive to a fully insured company, you may hear him or her disparage your quotes and broadcast a lot of misinformation. At the same time employers may have questions you need to know how to answer. MBA is here to assist.

Getting to Know MBA Benefit Administrators.

Does it matter which third party administrator you choose? Don’t they all do the same things?

All TPAs offer claims adjudication. But MBA’s secret weapon is in their multiple cost containment strategies and partnerships and how they can cut employer’s claims expenses and how this has a big impact on renewals the following year. These practices allow MBA to repeatedly offer renewals below current year costs and is a big reason the average client stays with MBA for 12 years…unheard of in the health insurance market. That’s good for employers – AND YOU!

Further Actions to Take Now:

If you have already begun building a list of businesses to call for health insurance renewals and quotes but still feel a little uncertain, call us. We can set up a one on one discussion to go over your questions or concerns

For more resources Click on this link. You’ll be taken to a page just for brokers. Once there you’ll find two things:

-

A whiteboard presentation presented by Phyllis Merrill, CEO of MBA Benefit Administrators. It is a recap of what we just covered, presented in front of employers.

-

HIPAA Compliance Training: Regulations within the Health Information Portability and Accountability Act are a big deal and you will constantly run into HIPAA in the larger group market. We offer HIPAA compliance training to protect you and us. Each of the two 15-minute videos includes a 10-question quiz you must pass to sell for MBA.

Don’t wait, start learning more about how self-funding can help your clients

Contact Us

Learn more about how The Open Solution™ offered by MBA Benefit Administrators can work as the healthcare advocate for your organization. We provide medical case management, third party administration, fiduciary protection and auditing and re-pricing services that bring your organization big savings. You are making a decision to contain your medical expenditures, and protect your financial interests while maintaining a high quality care for each and every plan member. You are not alone in the quest to provide necessary benefits and to navigate to pitfalls of the healthcare industry. We’re with you every step of the way!

About The Open Solution™ | Cost Savings Estimator | FAQs | Success Stories | Contact Us

Phone: 855-743-6070 (toll free)

801-743-6070 (local)

Mail: P.O. Box 57340

Salt Lake City, UT 84157-0340

Email: info@theopensolution.com

Powered by MBA Benefit Administrators.

Abraham Lincoln said, “Our commitment is what transforms our promises into reality. It is our words that speak boldly of our intentions, and our actions which speak louder than words. It’s being on time when we promise. It’s coming through time after time, year after year after year.” And that is our commitment to you.

Mission Statement

“As a team of professionals, we are committed to delight those we serve with quality service, excellent performance, and respect for their individual needs. We are dedicated to fostering an environment of productivity, job satisfaction, harmony, and a willing attitude. We are committed to the highest standard of honesty, personal integrity, and fairness.”