Choose Your Own Affordable Care Act Adventure

Does your company have at least 50 full-time equivalent employees? If so, providing health coverage is a new requirement beginning in 2014 according to the Affordable Care Act, otherwise known as Obama Care. Wading through the information about the ACA can seem like a daunting task. MBA is a Third Party Administrator who helps guide HR professionals, CEOs, insurance brokers and other management through the task of understanding, strategizing and implementing health care coverage for groups.

Does your company have at least 50 full-time equivalent employees? If so, providing health coverage is a new requirement beginning in 2014 according to the Affordable Care Act, otherwise known as Obama Care. Wading through the information about the ACA can seem like a daunting task. MBA is a Third Party Administrator who helps guide HR professionals, CEOs, insurance brokers and other management through the task of understanding, strategizing and implementing health care coverage for groups.

You have questions. Employees have questions. Where are the answers?

If you are like most business owners, or managers, you may be expecting your insurance broker to fill you in on all the details regarding your plan. You may be silently waiting to pass into this new era, hoping that the plan you have now will adequately cover the needs and requirements set by the new law. Regardless of your situation, you are like many who are asking a lot of questions.

Common Employer Questions

“What are the requirements for providing coverage?”

“What are the minimum benefits necessary to avoid paying penalties?”

“What is this going to cost me?”

Common Employee Questions

“Does my employer provide benefits?”

“Do I accept benefits provided by my employer?”

“Do I opt out of employer sponsored benefits and buy an exchange policy?”

“Based on my wages, do I qualify for a subsidy?”

Enjoy This Adventure!

With the creation of the Affordable Care Act, otherwise known as Obama Care, you now have the opportunity to choose your own adventure when it comes to providing health care coverage to your employees. Just like the children’s stories, where the reader can choose what happens to the character at the end of each chapter, you too can take control of how the ACA will affect your decisions, your employees and your bottom line.

There are a wide range of regulations and new mandates. You are entitled to understand these regulations, as well as make decisions based on what is best for your company.

The three main characters that need attention while determining what health benefits will be provided include: the employer, the employees, and the government.

The first character in this story is the employer.

The first character in this story is the employer.

The decision makers in this category may include the CEO, the company owner, and HR professionals. It is vital to the long term success of the company to examine your health care strategy. There are options that will allow the company to comply with the law, while saving thousands of dollars. So, be smart. Pay attention. Lean on experts, such as MBA, to help guide the way.

The second character in this story is the work force, or employees.

With new requirements to have health care coverage, there are many choices for employees to make. For example, do they take advantage of the insurance provided, or do they qualify for a subsidy? It’s important to educate HR, and the management team about the laws and regulations. This will empower them to help employees make the best possible decisions for themselves and their families.

The third and final character in this story is the government.

When in compliance with the law, the company will not be penalized. Click here for a short list of ACA requirements. However, if the company has 50 or more full time equivalent employees and does not offer adequate coverage, or coverage at all, the company will be penalized in the form of a tax.

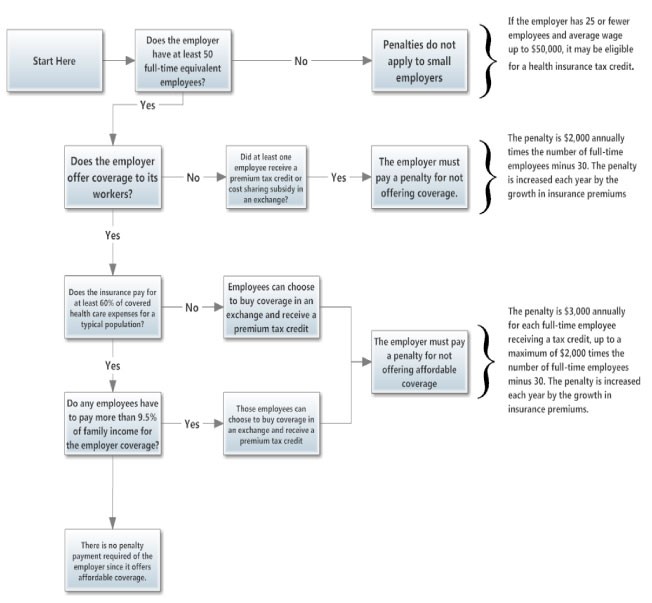

Below is a short survey that can help determine where your company is right now with providing health care benefits. You can also begin to formulate the cost that will accumulate if you choose to accept fines, versus adapting and changing what coverage you offer.

Work with us. Let us help create an individualized strategy for your work force that can improve the outcome of your adventure. Call us today to schedule your free, no obligation consultation where we can map out your upcoming health care success strategy.

Choose Your Own ACA Adventure

Question 1: Does the employer have at least 50 full-time equivalent employees?

If the answer is no:

If you have fewer than 50 employees, penalties do not apply to you. In addition, if you have 25 or fewer employees with an average wage of up to $50,000, you may be eligible for a health insurance tax credit.

If the answer is yes:

Carry on to question 2.

Question 2: Does the employer offer health coverage to its workers?

If the answer is no:

Did at least one employee receive a premium tax credit or cost sharing subsidy in an exchange? If the answer is yes to the above question, the employer must pay a penalty for not offering coverage.

The penalty is $2,000 annually, times the number of full- time employees, minus 30. The penaty is increased each year by the growth in insurance premiums.

If the answer is yes:

Carry on to question 3.

Question 3: Does the insurance pay for at least 60% of covered health care expenses for a typical population?

If the answer is no:

Employees can choose to buy coverage in an exchange and receive a premium tax credit.

However, the employer must pay a penalty for not offering affordable coverage. The penalty is $3,000 annually for each full time employee receiving a tax credit, up to a maximum of the numbers of employees, minus 30, times $2,000. The penalty is increased each year by the growth in insurance premiums.

If the answer is yes:

Carry on to question 4.

Question 4: Do any employees have to pay more than 9.5% of family income for the employer coverage?

If the answer is yes:

Those employees can choose to buy coverage in an exchange and receive a premium tax credit.

However, the employer must pay a penalty for not offering affordable coverage. The penalty is $3,000 annually for each full time employee receiving a tax credit, up to a maximum of the numbers of employees, minus 30, times $2,000. The penalty is increased each year by the growth in insurance premiums.

If the answer is no:

There is no penalty payment required of the employer since it offers affordable coverage.