Self Funded Insurance

By Executive Order from President Trump, the Dept. of Labor has been instructed to draft language allowing for Association Health Plans. This will allow small employers and the self-employed to purchase health coverage based on “commonality of interest” as opposed to current regulations which require a common employer relationship. This is potentially good news for…

Read MoreIt’s all about taxes. According to the Affordable Care Act of 2010, requiring the purchase of a product is illegal, but mandating a tax for not purchasing that product is legal. At this point, as a business owner, insurance broker, or HR professional, you have weathered the first season of regulations that have come, but…

Read MoreBy SPBA Active Past President Fred Hunt – September 8, 2015 As a starting basis, it is important to remember that employee benefits are a political orphan. Neither party nor left nor right are a natural enemy or friend of employee benefits. The good news is that we are not automatically on anyone’s political hit…

Read MorePhyllis Merrill, CEO of MBA Benefit Administrators attended SPBA’s annual conference, held this year on March 18-20 in Washington DC. Merrill participated in a group discussion, with other leaders in the industry. Those in attendance included DOL, IRS, the Department of Health and Human Services, EEOC, and others. While most of these topics are still…

Read MoreDid you know that roughly 100 million Americans are covered by their employer’s self insured health plan? 57% of all health benefit plans in the United States are self funded. Thanks to the passage of the Employee Retirement Income Security Act (ERISA) in 1974 by Congress, regulations utilized by self funded plans include special exemptions…

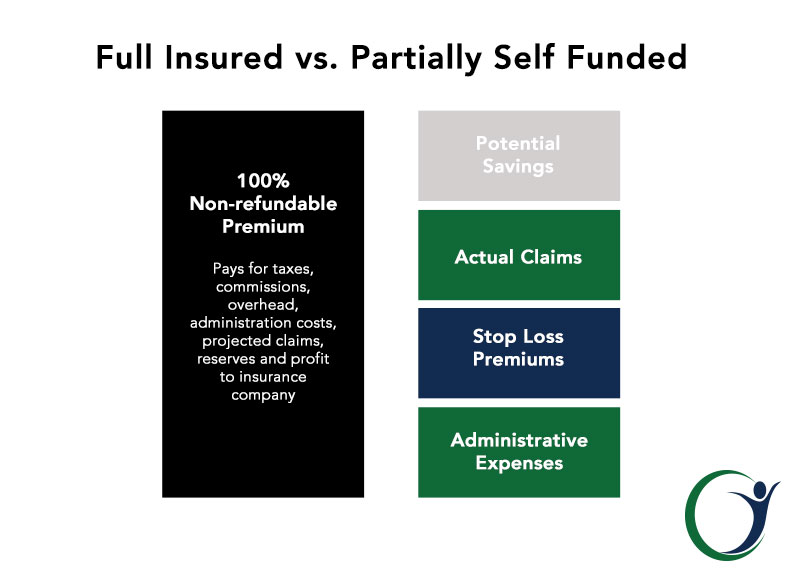

Read MoreOver the past few years, many companies have evaluated the increasing premium costs associated with their group medical insurance programs and have looked for ways to improve cash flow and economize on the budget for employee benefits. This has given rise to partial self funding and insured stop-loss managed platform. Any company with more than…

Read MoreHealth premiums have risen 97% in the past ten years. For most companies, medical costs are the second largest budgetary expense, next to payroll. That is more than advertising, production, inventory, research and development, building space. You name it. The cost for health insurance is also rising fast than salaries. Are healthcare premiums squeezing your…

Read MoreIf you are a human resources professional, an insurance broker, or a business owner dealing with medical benefits, the audacious challenge of choosing and managing healthcare can seem a bit overwhelming, especially with the new ACA regulations. At MBA we have been working as a third party administrator for over thirty years, and we are…

Read MoreBy Sarah Johnson Are you looking for a self funded health care plan that offers high quality medical care while at the same time providing protection against egregious costs? At MBA, we offer both to our members by implementing a new program CostPlus. As a third party administrator we work with medical providers and employers…

Read MoreBY NATHAN SOLHEIM www.benefitspro.com, May 14, 2012 Now that health care costs keep going up, people are looking for alternative ways to finance health care—including self-funding. Employers these days are looking at ways to control health care costs. They hear that health care is an important benefit to their employees, but face the task of…

Read More